Structural Shift to High-Yield Non-Denim Portfolio; Balance Sheet De-risked with India Ratings ‘Positive’ Outlook Ahmedabad (Gujarat) [India], February 14: Varvee Global Limited (“VGL” or the “Company”) has announced its financial results for the quarter (Q3 FY26) and nine months ended December 31, 2025 (9M FY26). The results mark a strategic inflection point, as the Company

Structural Shift to High-Yield Non-Denim Portfolio; Balance Sheet De-risked with India Ratings ‘Positive’ Outlook

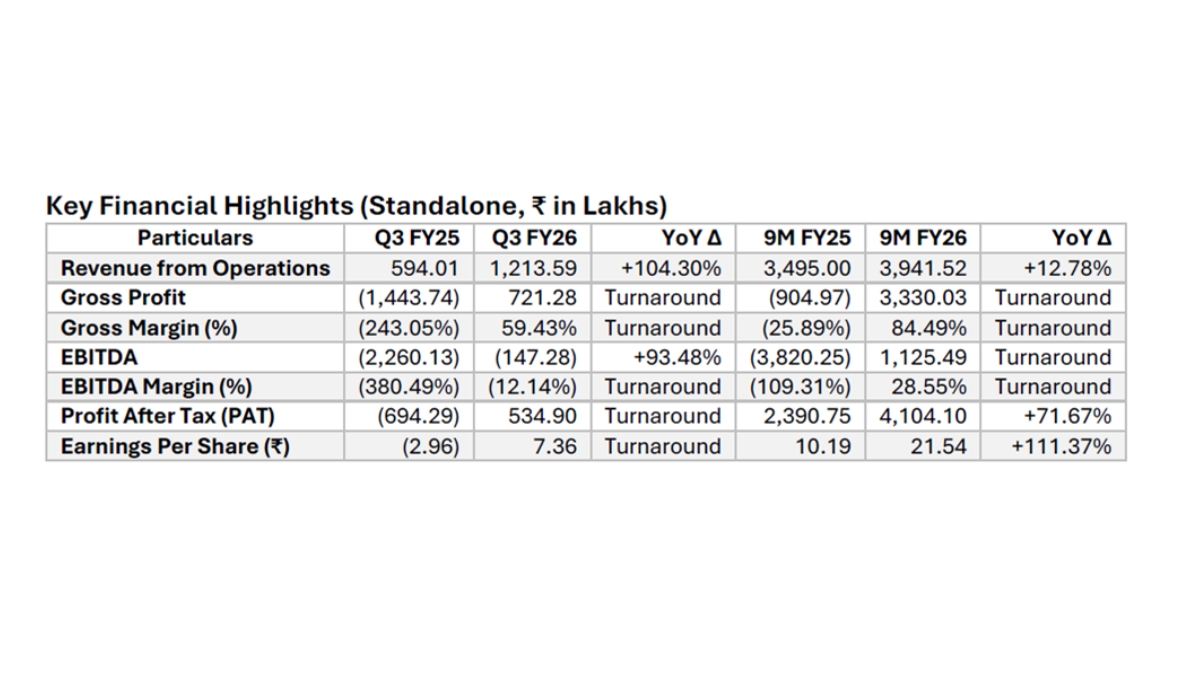

Ahmedabad (Gujarat) [India], February 14: Varvee Global Limited (“VGL” or the “Company”) has announced its financial results for the quarter (Q3 FY26) and nine months ended December 31, 2025 (9M FY26). The results mark a strategic inflection point, as the Company transitions from a successful operational turnaround to a high-velocity growth phase, characterized by sector-leading margins and a fortified capital structure.

Q3 & 9M FY26 Key Takeaways

The Company achieved a significant 9M EBITDA turnaround, reaching ₹1,125.49 lakh compared to a loss of ₹3,820.25 lakh in the prior-year period. While the Q3 EBITDA remains slightly negative due to timing and reinvestment, the 93.5% reduction in Q3 operating loss reflects a trajectory toward sustainable profitability.

VGL’s deliberate shift away from legacy, commoditized denim toward value-added Non-Denim Shirtings and Suitings is now reflected in its 9M Gross Margin of 84.49%, a turnaround from a negative margin last year. This represents a substantial bps expansion YoY, proving the superior unit economics of the new management’s product mix alongside an 86.1% reduction in 9M raw material costs following a strategic portfolio rationalization.

While 9M revenue grew 12.78%, 9M PAT surged by 71.67% to ₹4,104.10 lakh. This highlights significant operating leverage, where a lean, restructured cost base, including a reduction in employee costs achieved earlier in the year, is translating incremental revenue directly to the bottom line.

Employee expenses for the nine-month period were reduced by 48.69% YoY to ₹307.67 lakh, showcasing the lean operational structure implemented by the new leadership.

Finance costs for Q3 were effectively eliminated (₹0.03 lakh), a 99.99% reduction from Q3 FY25, following the full retirement of high-cost legacy debt.

Institutional Milestones: Credit Rating & Capacity Scaling

In a major institutional milestone, India Ratings and Research assigned an ‘IND BB/Positive’ issuer rating to VGL on January 28, 2026. This follows the withdrawal of the legacy ‘IVR D’ (Default) issuer non-cooperating rating by Infomerics on December 31, 2025, after the Company secured “No Due Certificates” from all major lenders, including SBI and Bank of Baroda, as well as confirmation of “No Dues” with respect to its fixed deposits. The ‘Positive’ outlook displays the Company’s robust liquidity and the sustainability of its turnaround.

On January 5, 2026, VGL announced a 50% increase in production capacity for non-denim fabrics, scaling from 12 lakh to 18 lakh meters per month. This is an interim step toward the management’s long-term goal of 50 lakh meters per month, positioning VGL to capture high-margin demand in a domestic textile market projected to reach USD 250 billion by 2030–31.

Management Outlook

“Our Q3 and 9M results reflect a fundamental turnaround in VGL’s earning capability. By delivering 9M gross margins of 84.5% and achieving a positive 9M EBITDA, we have proven that our focus on premium non-denim fabrics is the correct path for long-term growth. The assignment of a ‘Positive’ rating outlook from India Ratings marks our transition into a more stable, institutional-grade financial profile. We are now aggressively scaling; our expansion to 18 lakh meters per month is just the first step toward our 50-lakh-meter goal. We remain committed to compounding free cash flow and maintaining a debt-free balance sheet as we capture the expanding opportunities in the Indian textile market.”

— Mr. Jaimin Gupta, Chairman & Managing Director

About Varvee Global Limited & TAM

Headquartered in Ahmedabad, Varvee Global Limited (previously known as Aarvee Denims & Exports Ltd.) is a leading integrated textile manufacturer offering a comprehensive range of denim, non-denim, shirting, and suiting fabrics. Operating primarily from its Narol facility, Varvee Global Limited delivers end-to-end in-house capabilities, from yarn production to finishing, ensuring consistency in quality and flexibility in supply. Over three decades, Varvee Global Limited has built a vertically integrated platform serving domestic and international markets. Following a strategic restructuring and leadership transition in 2025, Varvee Global Limited now operates from its high-capability Narol unit, with a renewed focus on operational efficiency, cost optimisation, and technology-led supply chain enhancements.

The Company achieved a debt-free status in June 2025, providing a stronger capital foundation to execute its revival plan. The Indian textile market, valued at USD 146.55 billion in 2024, is projected to reach USD 213.51 billion by 2033, with domestic demand and exports expected to hit USD 250 billion and USD 100 billion, respectively, by 2030–31. Within this, India’s denim industry has an installed capacity of 1,700 lakh meters, producing around 1,000 lakh meters annually (60–70% utilization), and the denim apparel market is forecast to grow from USD 1.14 billion in 2024 to USD 1.83 billion by 2033 at a 5.04% CAGR, with other estimates projecting USD 9.15 billion by 2026 at a 14% CAGR. Varvee Global Limited’s strategy is centred on expanding into emerging markets, diversifying into value-added fabrics, and aligning with global sourcing trends to capture new opportunities in both fashion and industrial textile segments.

With a heritage of manufacturing excellence, a restructured balance sheet, and a future-ready operational model, Varvee Global Limited is positioning itself for sustainable value creation in the textile industry.

Sources: Wazir Advisors, IMARC Group, MarkWide Research, IJIRT, PIB, and Henry Textile.

If you object to the content of this press release, please notify us at pr.error.rectification@gmail.com. We will respond and rectify the situation within 24 hours.